Emerita Resources – Key Metrics And Takeaways From The Updated IBW Mineral Resource Estimate And Update On Legal Proceedings At The Aznalcóllar Project

David Gower, CEO and Chairman of Emerita Resources (TSX.V: EMO) (OTCQB: EMOTF), joins me to outline the key metrics and takeaways from the updated Mineral Resource Estimate announced on March 11th on the wholly owned polymetallic Iberian West Project (IBW), located in southern Spain. We also get an update on the legal proceedings at the Aznalcóllar Project later in the conversation.

The Mineral Resource Estimate is based on 105,554 meters of drilling by the Company comprising 299 drill holes and is hosted in three volcanogenic massive sulphide deposits on the project; La Romanera (LR), La Infanta (LI), and the more recently delineated El Cura (EC) deposit (LR=169 holes totaling 70,344m; LI=91 holes totaling 20,975m; EC=39 holes totaling 14,235m). All three deposits remain open for further expansion by future drilling. The IBW project is reporting:

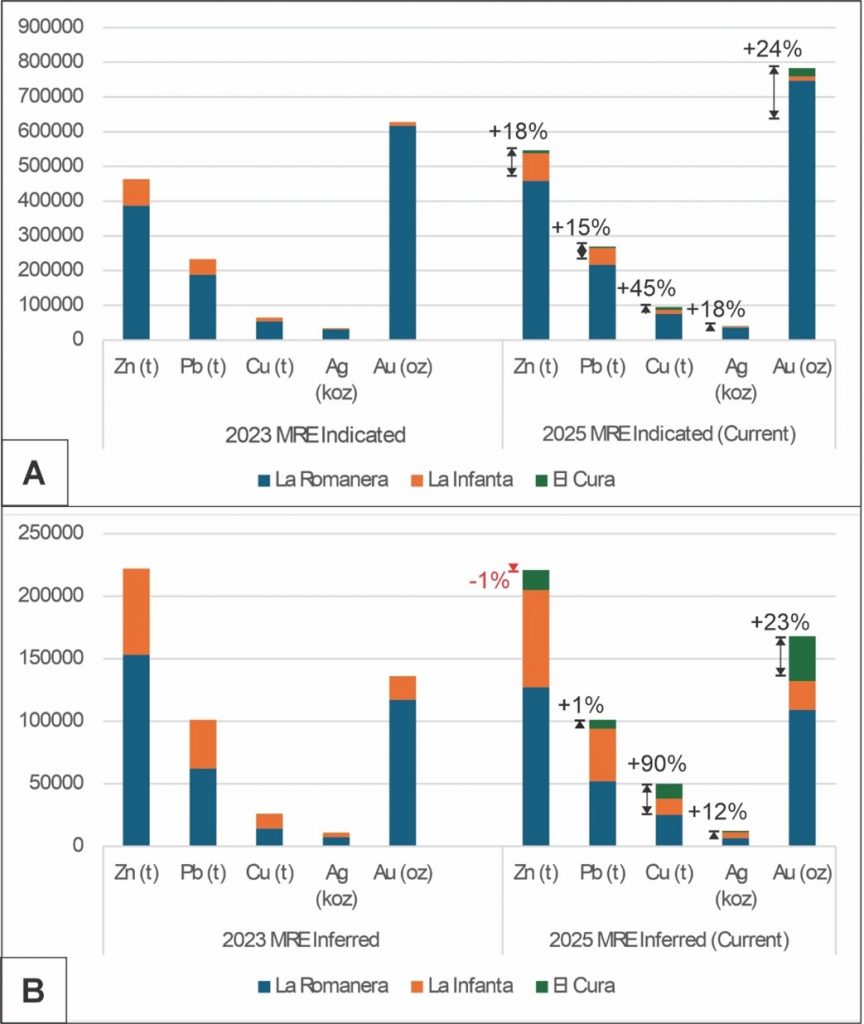

- A Total Indicated MRE of 18.96 million tonnes grading 2.88% zinc, 1.42% lead, 0.5% copper, 66 g/t silver, and 1.28 g/t gold (8.44% ZnEq or 3.01% CuEq);

- A Total Inferred MRE of 6.80 million tonnes grading 3.25% zinc 1.50% lead, 0.73% copper, 56.3 g/t silver, and 0.77 g/t gold (8.72% ZnEq or 3.00% CuEq);

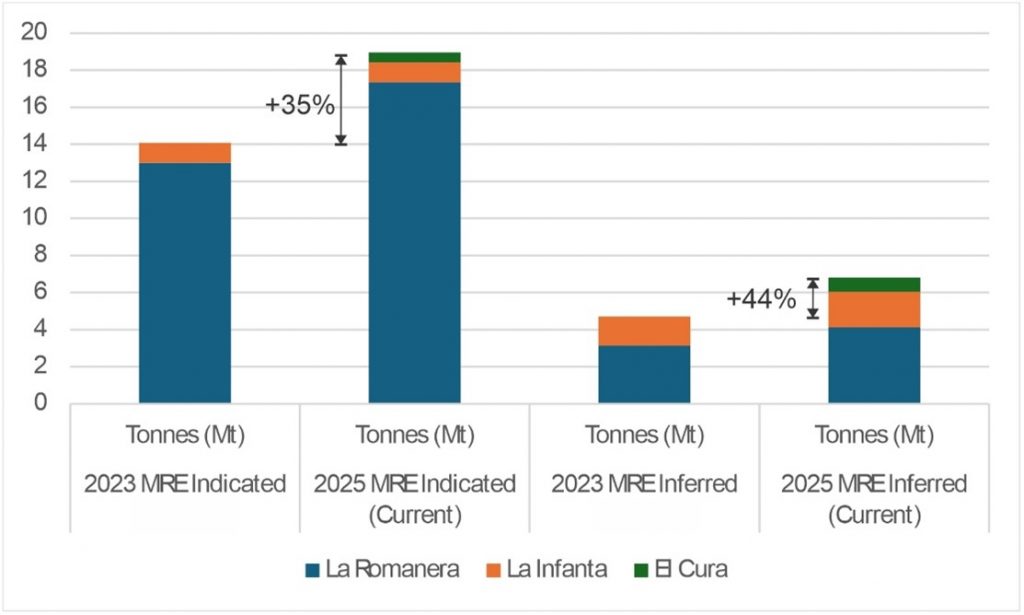

- The updated Mineral Resource Estimate achieves numerous improvements when compared to the previous May 23, 2023 MRE, which include a +35% increase in Total Indicated MRE tonnage and a +44% increase in Total Inferred MRE tonnage;

- There was also an increased gold metal content within the Total Indicated MRE from 629 Koz to 783 Koz, which is an increase of +154 Koz (+24%) with a likewise increase in contained gold within the Total Inferred Resource from 137 Koz to 168 Koz or an increase of +31 Koz (+23%) gold, respectively;

El Cura is still being drilled with 4 rigs, and is located in between La Infanta and La Romanera, but more closely resembles La Romanera metallurgically, returning higher gold values along with the base metals. David walks us through how each of these 3 deposit areas plays into the larger development strategy, where the earlier stage mining decline at La Romanera can now drift through El Cura on the way to the development of La Infanta, bringing in El Cura in as a future economic driver much earlier in the mining sequence. We discuss all the derisking work going on in the background building toward the PFS this year, as well as an update on the environmental permits anticipated to come in over the next couple months.

We wrap up getting an update on where things are in the courts, with the sentencing portion of the legal proceedings have commenced on March 3rd, furthering the clarity on whether Emerita Resources will be awarded the high-grade polymetallic Aznalcóllar Project later this year, as the only other qualified bidder at the time.

If you have any follow up questions for David regarding Emerita Resources, then email those in to me at Shad@kereport.com.

.

Click here to follow the latest news from Emerita Resources

.

.

Dovish Central Banks Support Gold Above $3000

David Erfle – The Junior Miner Junky – Friday March 21, 2025

https://mailchi.mp/37bf796ec0c0/david-erfle-weekly-gold-miner-sector-op-ed-19219897